I’m sure my readers don’t need to be told that 2023 is proving to be a challenging year for investors.

So challenging, in fact, that risk mitigation is fashionable again. No longer do investors pour money into any project that ends with .com or promises to ‘address climate change.’

I was reminded of this today as I munched bitterly on my breakfast while reading this report:

There is a natural mitigation strategy for retirees against being slugged with extra taxes and that is to earn nothing and own nothing. (Although they will try to tax what I spend.) So on the bright side, the more Government we have of the calibre that all governments sink to, then the sooner we will be free of the taxation risk as we all get sent broke by being slugged with new taxes. Too dark?

What about other mitigations? One of my favourites is the oil business. Stop me if I’ve told you before about my 6.2 litre V8 SS Holden, 6 speed manual gearbox, rear tyres so wide they almost meet at the differential. A joy to drive and it must be the world’s best performance car, given the price it sold for when new. Hint, I could easily get more on the second hand market today than what I paid for the new car 6 years ago. Now, it does use more than its fair share of petrol and prices at the pump are not what they used to be. So it is doubly pleasing to see my risk mitigation strategy number 2 working: the value of my oil stocks performing exceedingly well on sharemarkets while the petrol price goes up.

That’s why I always like investments in tobacco companies for smokers. Tobacco companies require relatively little capital reinvestment in plant and equipment. You have a look at their expenses, particularly depreciation. They are hard to find. Cash cows, is the term. Have you seen how they churn out profits and dividends year after year?

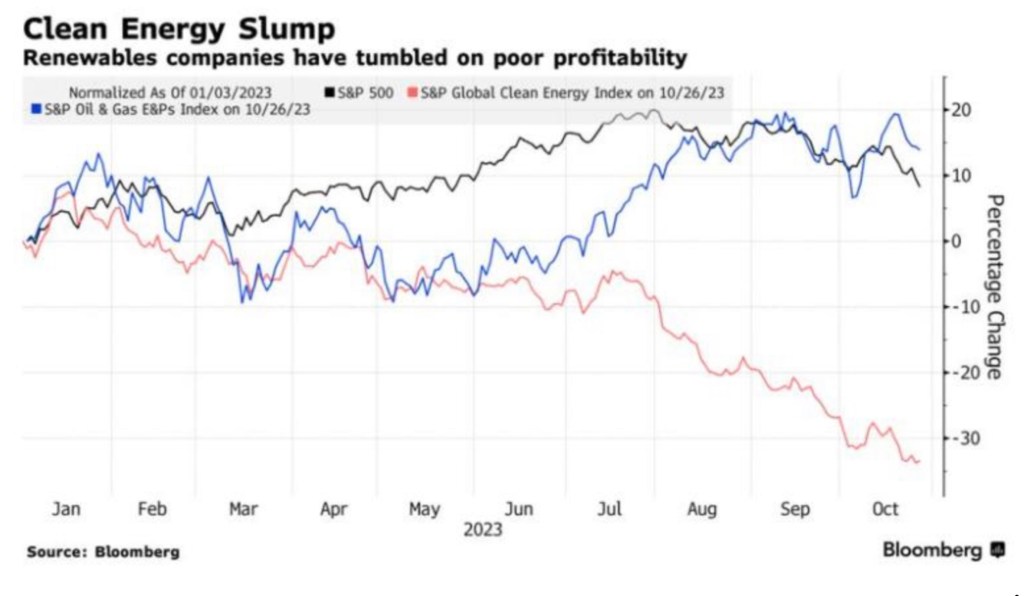

Mitigation strategy number 3 again relates to Government silliness. Governments the western world over shovel mountains of cash at investment in renewable energy projects. They do it via subsidies, tariffs, competition restraints etc. Of course, there is no such thing as a Government entity. A government is merely a collection of individuals who have control over our money (read taxes) with the threat of penalties if we refuse to pay and the temporary control of the legislature. So Government shovelled cash is our money. They’ll send us all broke, unless, that is, the renewable energy projects go broke first. Don’t shed any tears for the rapidly emerging losses across the renewable energy projects. Check out their performance this year to date, as measured by the S&P Global Clean Energy Index:

This must rank among the better news stories of 2023. Mitigation strategy number 3 is that government chosen preferred businesses go broke before the taxpayer. But only just.