In a break from my Australian inflation bulletins, let’s take a look at the US. What is happening to the mighty dollar? In short, it is unhealthy.

Remember, general price increases are caused by a weaker currency. Currencies are made weaker when the money supply is increased at a faster rate than economic growth. The origin of the term inflation was an ‘inflated’ money supply. For political expediency, the term became price inflation as measured by a price index. This allowed a certain amount of blurring cause and effect. That is blame deflection by governments.

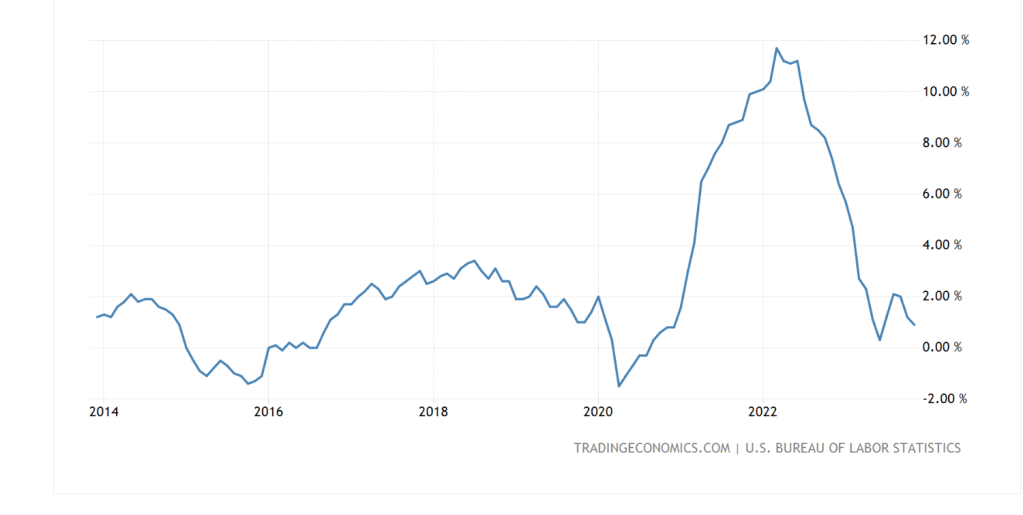

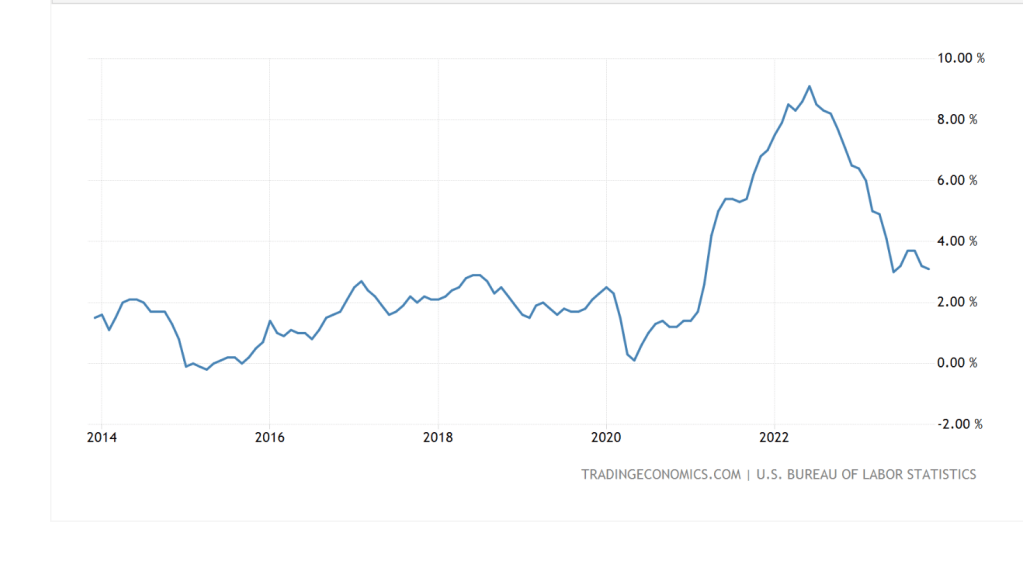

In the US, we can see the familiar pattern: a rapid increase in the money supply (ie the inflation) leads to an increase in producers’ prices that leads to an increase in consumer prices. The price rises follow the money supply increase.

The rapid increase in M2 was followed around 1 year later by the spike in producers’s prices.

Then followed after a short lag the rapid rise in consumer prices.

Since the start of 2022, the money supply has stabilised and come down marginally. Hence the growth in prices has reduced. They are still rising, but just not as quickly. With a permanently elevated money supply, the prices in general remain permanently elevated. The damage to the dollar has been done.

This explains in large part why the price of gold has rocketed up. The dollar ain’t what it used to be.

Can this be fixed? Of course it can. Will it? Judging by experience and an understanding of the nature of political incentives, it won’t be.