It’s hard to keep up, sometimes. A decade or so ago, it was hard to keep up with the new paradigm, the “this time it’s different” mantra that to most sensible people reignited painful memories of the previous time it was different.

Back then, Climate Net Zero and ESG were all the rage. The dubious and doubtful were dismissed with “they just don’t get it.” Investment fund managers and market makers promoted ESG funds with green credentials that would simultaneously save the planet and deliver better returns. Investors in carbon based energy sources “would be left with stranded assets, probably by next Tuesday,” they said. “The world is transforming right now. It’s important not to be left behind. It’s the right thing to do!” they claimed, clutching their pearls.

The warning signs were showing when the new term greenwashing moved into the lexicon. Market regulators were finding some so called ‘green’ mutual funds were not as green as the promoter had promoted. Some were considerably brown and black, that is, in the form of oil and coal assets. Investors were being duped.

At the start of 2025, Blackrock stunned green fund aficionados.

Now it’s getting hard to keep up.

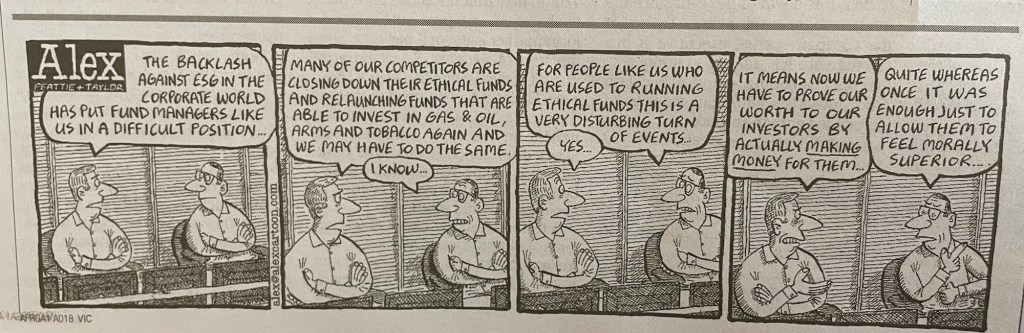

Meanwhile the authors of the long running Alex cartoon have always had excellent inside contacts to find out what is really going on.