In my previous bulletin, I said the optimism was possibly overblown. By the end of 2023, many pundits proclaimed that inflation had been tamed. Stock markets staged a remarkable comeback. However, in the last few weeks, that balloon of optimism has been punctured well and truly.

Continue readingHow not to win clients or influence people

If you were a top executive of the world’s largest asset manager and a client withdrew US$8.5b from your management would you:

a) Be disappointed and then talk privately to the ex client about their rationale, or

b) Issue a public letter to the ex client condemning their actions as putting short term politics over fiduciary obligations and urging them to reconsider their decision?

Continue readingInk spots and the change of season

I’m in the habit of keeping a tissue in my pocket. At this time of year, it can be a risk to my dignity.

Continue readingAustralian energy mix, summer 2024

Summer, the 3 months from the solstice to the equinox, has just ended in the southern hemisphere. How did Australia generate its electricity over that time? With renewables?

Continue readingLet’s revisit

Nearly 8 years ago, I published this piece. I could republish it today without changing anything.

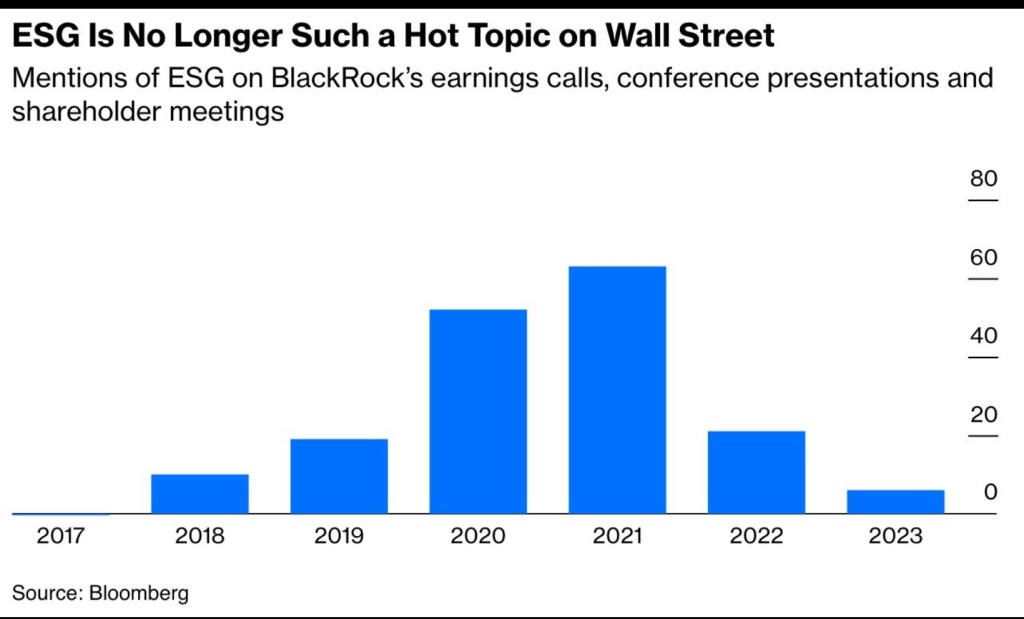

Wall Street

The Wall Street traders have been reading my blog.

Blackrock SEC filing discloses knowledge of ESG risk

Blackrock has lodged its 2023 annual report with the US securities exchange this week. It contains an interesting disclosure.

Continue readingInflation bulletin

Stock markets have been pricing in the anticipated end of inflation for the last little while. Is Mr Market right?

Continue readingBP – back to petroleum

It must be around 20 or 25 years ago that BP rebranded itself: Beyond Petroleum. Remember?

Continue reading