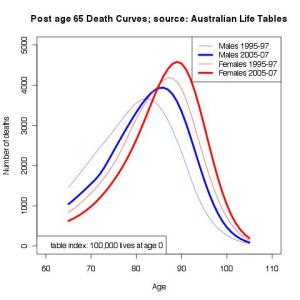

The shape of death matters to policy makers, not so much to the individual. This image shows the number of expected deaths from age 65, based on a normalised starting group of 100,000 lives at birth. The underlying data has been extracted from the Australian Life Tables, published by the Government Actuary. Two tables are plotted here, based on studies in 1995-97 and 2005-07. Continue reading

Author: AustralianActuary

The rising cost of #risk benefits in Australian #superannuation schemes

Most Australian super schemes provide benefits to members or their dependants on disablement or death. Typically, the cost of that insurance is deducted from the accumulated balances of the members. Those insurance costs are now rising rapidly almost across the board. Increases of 50% to 100% are common.

As a result, fund members will see large increases in the amount deducted from their balances to pay for the insurance. As a sad indictment on the engagement of members in their schemes and benefits, many fund members do not even know that they are insured.

The reason for the premium increases is clear – claims are higher than premiums collected. Continue reading

Stakeholder analysis by #ASFA starts at the wrong end

In the December 2013 edition of Superfunds magazine, the CEO of ASFA, in her regular column, discusses the three major groupings of stakeholders in the superannuation system in Australia. In order, they were listed as 1) policy makers, 2) the general community and 3) individual fund members. When listing the fund members as the third group, the author said that individual fund members are “arguably for many, the most important”.

If I were writing that column, I would have reversed the order and dropped the “arguably” clause. Fund members are the most important stakeholders. The rest simply do not matter.

Federal Court judge interference in the Australian labour market

Mordecai (Mordy) Bromberg is a judge in the Federal Court of Australia. Several days ago, he ruled that a car manufacturing company in Australia was not permitted to put an industrial matter to its employees for a vote. The issue was over a planned amendment to the workplace agreement that is currently in place. The company’s stated intention was to reduce costs in the business to improve productivity. Reading between the lines in the context of car manufacturing in Australia, it is also likely that the future of the business is under question.

Instead of allowing employees to vote on the matter, the judge ruled no vote was permissible.

In a free and productive society, employers and employees voting on matters that concern them is surely a sign of common sense, maturity and respect for freedom. In the event that a judge deems such behaviour should be prevented, then some other force is at work. It is not a force to be welcomed if living standards are to be maintained.

The fatal conceit of regulators

Why do regulators of financial institutions issue regulations?

During my career, the volume and complexity of regulation of financial institutions has increased significantly. Executives and staff of banks, superannuation funds, insurers, credit societies and so on have laboured under an increasingly suffocating mass of obsfucatory laws, regulations, practice standards, guidelines to interpret practice standards, class orders, announcements and frequently asked questions. Why is it so? What problems have been fixed by any of these new regulations? Why should a regulator decide how insurers must determine a capital adequacy reserve? Why should a regulator determine what is an appropriate solvency margin for a superannuation fund?

Most, if not all, executives and staff of prudential regulators are well-intentioned. In my experience, they believe that regulation is necessary to guard against certain types of unsociable, unethical or simple incompetent behaviour by market participants to guard against losses adversely affecting the financial assets of consumers. The regulators believe that they can, to large extent, regulate away problems.

In the real world, problems cannot be regulated away. Laws against insider trading do not stop insider trades. Laws mandating certain solvency margins do not stop all insolvencies. Laws specifying in gory detail what numbers must appear on a periodic statement to a depositor do not make depositors any better informed.

Regulation is judgement. Why does a Government bureaucracy think it has better judgement about running an insurance company than the insurance company’s board of directors? When Governments regulate, they replace private commercial judgement with bureaucratic judgement. I have never met a regulator who knows the operations of a financial institution better than the executives of that institution. The fatal conceit of the regulator is to believe that they know best and that regulation is the key to financial stability and prudence.

Regulation promotes complexity and expense. Consumers pay for this.

The best form of regulation is that applied by institutions themselves, provided that there is no explicit or implicit publicly funded bail out mechanism should that institution get into trouble. Bail-outs change institutional behaviour.

#Superbugs and #retirement incomes

In some circles, it has become fashionable to predict that science is on the cusp of discovering how humans will be able to live to 1,000 years of age. In particular, Dr Aubrey de Grey believes that the first person to live to 1,000 has already been born. If true, that would probably open up another tedious round of debate about the level of the Australian Superannuation Guarantee needing to be higher than 12%. Continue reading

#Diversity and #Inclusion – and meddling bureaucrats

It is a requirement of Australian law that all employers that employ more than 100 employees must report to a Government department the breakdown of the employees by various characteristics such as gender, race, age and so on. ‘What for?’, I hear you ask. And that is a good question, one with no good answer that I can find.

I do not expect that anyone would seriously argue against diversity and inclusion in the workplace. The opposite would be homogeneity and exclusion and no business leader would nominate that as a way to improve the share price.

Diversity of people, ideas, motivations and personalities is good for group effectiveness. Inclusion of all people, rather than exclusion, means getting the best out of them. It is a no-brainer. So I do not think we have a problem. Continue reading

Uncommon causes of death – modern day problems

Reading studies into the causes of death is possibly a morbid habit but it does have a kind of fascination. If you read about causes of death today in wealthy countries, you will find that accidents and suicides take most of the under 40 year old deaths but then cancers and other neoplasms become more common the higher up the mortality table one advances.

It was not always so. In the year 1665, according to a summary of parish records in London, the most frequent cause of death was the plague. Continue reading

Does compulsory #superannuation benefit lower income earners?

There are many commentators in Australia who engage in their own particular battle of the history wars by claiming that superannuation was a Paul Keating invention that has provided great benefit for the lower income earners. If only life was so simple. Continue reading

The role of the consumer in driving down wages

The Australian Government’s curious attack on the 457 visa migration programme has spawned associated chatter on talk-back radio. One theme that reappears is that 457 visa workers are willing to work for less pay and employment conditions. This argument goes on to purport that there are plenty of Australian workers qualified to do the job but who want pay and conditions higher than business will pay because “those Filipino workers are more malleable”, in the words of one prominent ABC Melbourne morning radio show host. So, business is blamed for rorting the system to drive down wages and keep Aussies out of Aussie jobs.

The proponents of these arguments must have regard to the role of consumers in our economic system, and of course, those consumers include the unwitting commentariat themselves. Continue reading